With a cigarette company, there comes the ethics part of this ownership and I understand that some people refuse to own them. Overall, being in favor of drugs legalisation, and not in favour of organised crime, it fits with my preferences. It is also transforming smoking in a nearly risk free activity (compared to all the snack food tempting us everywhere) with the new products. But let’s not forget that it sells a lot of traditional cigarettes.

Business overview

British American Tobacco (or BATS), is a global cigarette business. 15% of revenues (and growing fast) are new categories such as vaping, chewing tobacco and heat sticks.

The company is truly global with 37% of revenues in the USA, 18% in Europe, 14% in Asia and 14% in Latam+Africa more or less.

Sales have been kind of stagnant and profit showed single digit growth recently. Cigarette volumes are decreasing but value is increasing through price rises. It is still a growth company because the low investment requirements leave much money for deleverage and dividends, or acquisitions. Profits doubled since 2014, despite large dividends.

Why? Because the company acquired Reynolds in the USA in 2017, raising debt a lot. However we are now back at 2.89 times net debt/EBIDTA which is pretty conservative, and shows the ability to delever while paying large dividends.

Emerging market catalyst

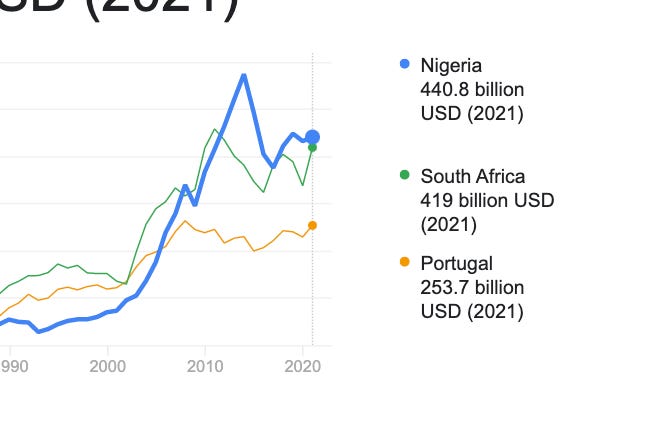

Short thesis: The price of cigarettes is directly related to the GDP. Coming of a decade of GDP stagnation in many emerging markets due to a resources bear market, global firms like BATS have an opportunity to realise pricing in emerging markets. Here is an example from Europe.

So when GDP grows in Poland and Romania, more profit goes to the Cigarette company (and the state). On a global basis, it’s even more.

For example:

USA: Total Combustibles (sticks bn) 59 -, Revenue : 10,470 B

EUROPE: (includes eastern Europe and Turkey) Total Combustibles (sticks bn) 206 Revenue : 4,996 B

Latin America and Africa: Total Combustibles (sticks bn) 149 Revenue : 3,751 B

Asia and Middle East: Total Combustibles (sticks bn) 207 Revenue : 3,813 B

Some regions sell 3 times the sticks that the US sell and make half the revenue of less.

Its pretty clear that the USA is the outlier here. The revenue and profit per stick is multiple times higher. We don’t expect a collapse of the USD in the future.

What does that mean? That means that BAT is under earning on future pricing potential in all these regions, and the pricing potential is huge. The majority of cigarette volume is in Emerging markets.

How to get pricing? GDP growth and currency repricing.

What is at the end of a 10 year cycle of currency depreciation? Emerging markets.

Some major EM gdps have been stagnating or down for 10 years. (Not all, India has boomed). Underinvestment in resources and mining being the cause.

What could happen? Large revenue growth in Emerging and frontier markets from BAT.

Am I sure it will happen? No, but if history is a tale, it should.

New products:

These products are much more safer than traditional cigarettes according to studies. These are Vaping, Chewing tobacco and Heat not burn.

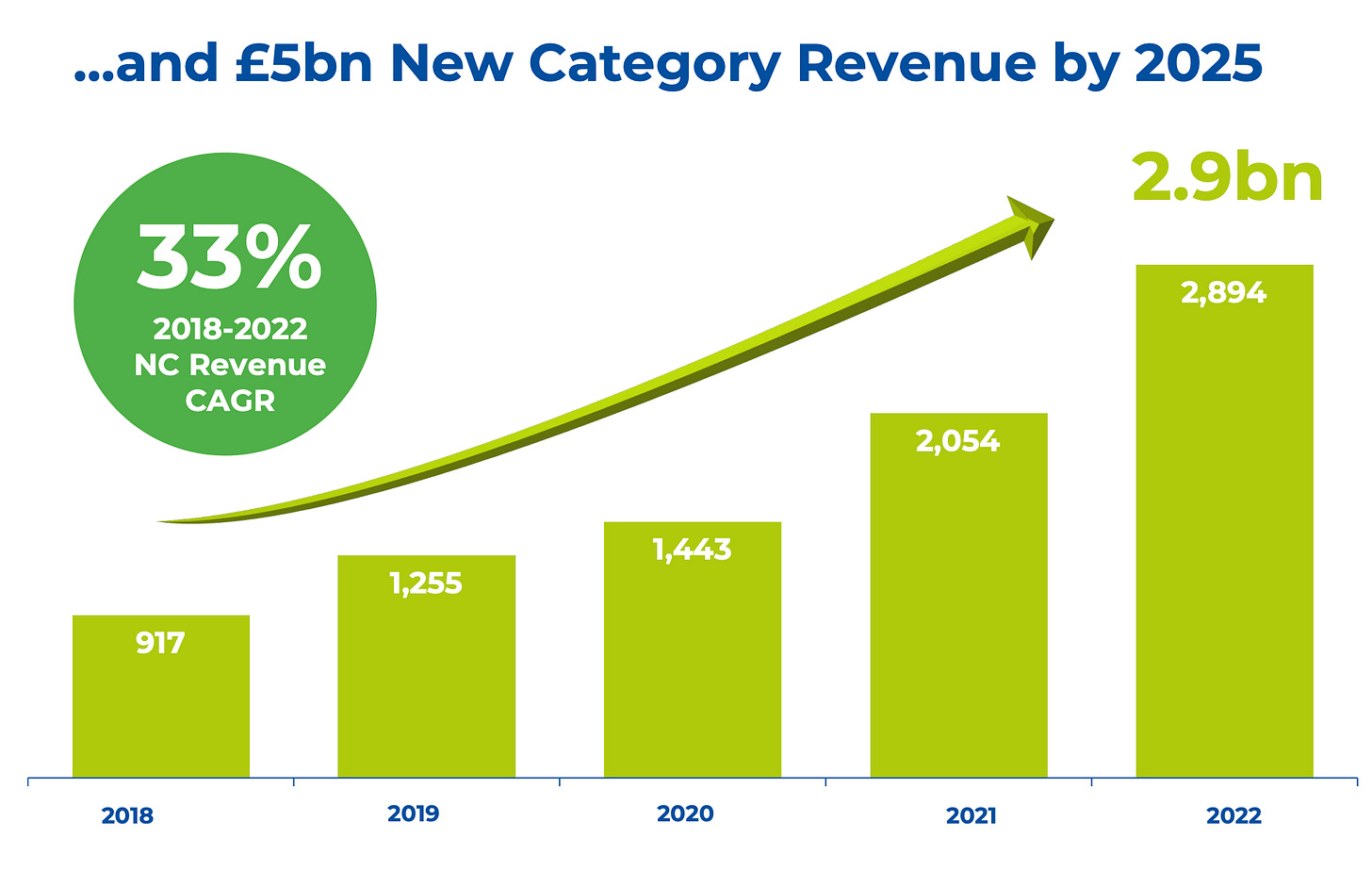

Revenue from new categories is up 40% in 2022, and now represent 15% of group revenue. The segment is currently unprofitable. So we have a start up segment a at loss that is given no value by the market.

Profit should come in 2024 and continue to grow in the future, while somewhat canibalising existing combustible profits, but not in every market, more in developed markets first. This will increase the group’s consolidated profit.

While Philip Morris IQOS reigns supreme in Heat not burn, I am certain that BATS Glo can get some market share against traditional cigarettes and IQOS as the starting market share is lower, and get decent profits in an oligopoly situation.

Philip Morris and BATS have the largest pockets and the most advanced investments in Technology. One can gain marketshare over the other but I expect these two players to share the new category profit pools, because both invest heavily.

Japan Tobacco is also investing heavily but they lag a bit. KT&G in Korea is also investing in new developments. Altria is disappointing here.

BATS leads the vaping category, but this can change quickly and Philip Morris could gain share. But in the end, there will be an oligopolistic situation.

The company is investing in Cannabis and Beyond nicotine and I think they will use their distribution network to push new products hard, the same way they did with new categories where they started from a very low position. They were not the leaders in Vaping and Heat not burn but they invested a lot to get into first or second position. The sheer financial and distribution power is enough to gain good share. They have the financial power to do transformative acquisitions in that space.

Strategy

-Grow in new categories and make them profitable.

-Return cash to shareholders at a 65% rate and deleverage with the 35% remaining.

-Grow in beyond nicotine, like CBD, cannabis. I think that once the company hits 2x Net debt/ ebitda (Currently 2.89), it will be able to maybe do larger acquisitions in the space. Will they be profitable companies or startup having no profits, that is a big question that would change the financial returns at least in the short term. I would prefer profitable companies, unless they can use their distribution network to turn a small startup in a billion dollar product.

-Cost savings.

Management

I don’t think there is anything specific with this management capital allocation. In the past few years, there was the Reynolds acquisition in 2017 which provided growth but extra risk on the US market. I am not a fan of it, but the company deleverage has been rapid, while paying dividends.

Risks

Accelerated decline in Cigarette volumes

Regulatory risk with Menthol in the US, since most of their sales there are Menthol. However I expect them to sell different products to the same customers and possibly reduced risk products if that happens.

Ban on new products.

Valuation

At a price of 3100p, we have a P/E Ratio of 8.x .This is too much of a discount with a net yield of 12% plus earnings growth of 4-5% (and that could increase), leading to shareholder yield of 16-17% per year.

A fair value would be 5% earnings yield or PE of 20, plus 4-5% of growth. or 9-10% returns yield. I know it sounds too high because it’s over 2 times our price, but it’s my maths.

Conclusion

BATS looks very cheap for a dividend position. I use it to fund reinforcements in other stocks. High dividend low growth companies can underperform for a while. But if you reinvest the proceeds at low valuations, it will still compound…something I guess?

Note: this is not financial advice, but my opinion on the company. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

Thanks for sharing. Love them in my dividend portfolio.