Emerging Value updates 8

Hello everyone !

Here comes another update.

Summary.

Newsletter update

Write ups

Company updates

Movements

Newsletter update:

Ahead of the H1 2025 portfolio update and after the crisis we had, I have updated the performance section of the website (May 19)

I have updated the significant winners and losers.

Alibaba was closed in Early 2025 at about 50%.

This is just the beginning for the portfolio and the full ideas are in the premium tier.

I had some losers too:

Significant bad performers under 40%

Yes I was adding to some losers, so it’s skewing the game, but these are real returns on my holdings based on my strategy.

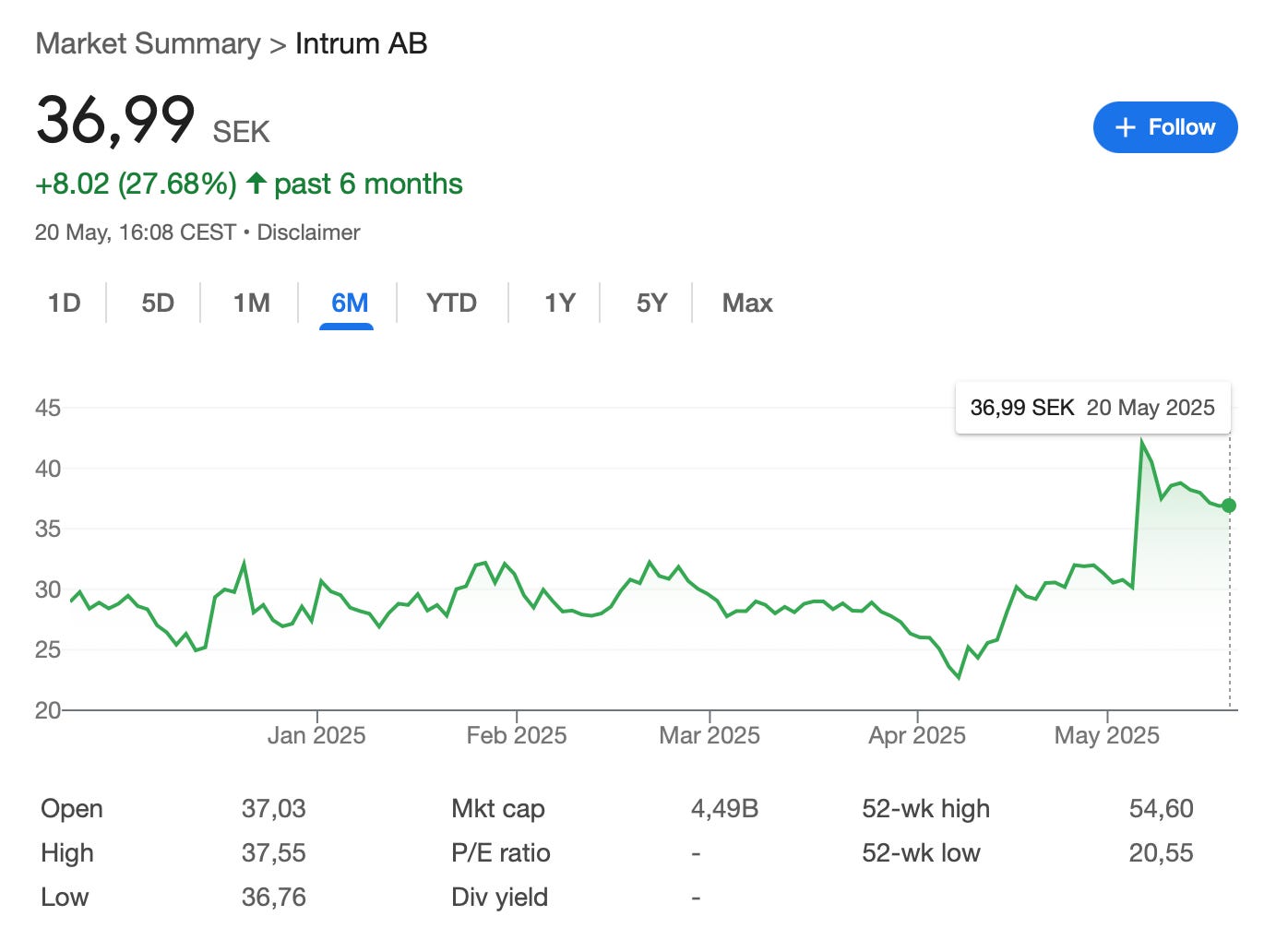

Intrum AB -48% since 2023 despite adding

10X genomics - 47% since 2024

Beximco Pharma -36% since 2021 despite adding so let’s keep it in the hall of shame

Vietnam holding - 33% since 2021 despite adding so let’s keep it in the hall of shame

A personal update:

I am now without a job. I Took a package from a declining business and I am at the crossroads.

The newsletter is not reliable enough, as most people don’t believe in my picks yet, or maybe want short term catalysts. I don’t really do this over promising thing.

So, I am testing several freelance ventures, that could let me have more time for investing related projects. I am also opened for more job opportunities since companies sometimes contact me.

My direct services are that I am an expert in E-commerce risk and fraud, such as chargebacks, disputes, revenue optimisation, and fraud prevention. I am fairly confident that I can get thousands saved or recovered for most businesses that have large volumes, unless they are already optimised very well.

Also, locally based coaching on what the stock market is, how to invest. Here, I think it’s more for people who are new and need to understand how wealth is created.

If you know some people interested, or if you have any advice and feedback, please let me know in the direct messages or on X. I will take it and I can provide more details.

I have also another project related to investing that I will try to grow in the mean time.

Thanks!

Genova Japanese small cap with growth

I wrote about Eurofins Scientific

Some quick news:

Cosan, a Brazilian holding company with good assets in energy, railways and agriculture, published terrible results, impacted by high rates, high debt, and bad commodity earnings. It’s crazy how debt and a poorly timed acquisition of Vale shares hurt Cosan. There will be a time to bet on the turnaround, but I do not see the improvements yet, due to the leverage.

In Chile, Argentina helped CCU aka united Breweries show a recovery in earnings. In my experience, beverage companies always come back. It seems that Argentina is on the come back.

In France and overseas, Cafom showed solid revenue growth despite a terrible environment, notably three stores destroyed due to Riots!

The Brazilian quality company I bought in 2024 showed the fastest turnaround ever with profit up 74% and share price already up 79%+. I don’t see a reason to sell this quality investment. (only for subscribers)

>For more ideas like this » Subscribe to the premium tier with the full access to the Emerging value portfolio.

Terravest industries:

* TERRAVEST INDUSTRIES INC. ANNOUNCES $240 MILLION BOUGHT DEAL OFFERING OF COMMON SHARES

I like companies that can do buybacks and share issues based on valuation and needs. It appears that it’s fairly or richly valued and issues shares. Eurofins also does this.

Intrum (Swedish debt collection company). Is showing that if there is an AI beneficiary in the market, it is Intrum. It reduces personal expenses thanks to the claim automation engine Ophelos. And it shows. Debt interest costs will also start to fall. I am getting more positive about Intrum but I have not been adding now, in order to favour companies that are not in turnaround situations.

The stock is starting to recover after Q1 earnings. But investors remain day traders remain very volatile in their price settling.

I have published the recent movements in two articles, with also earnings updates.

Subscribing gets you

10+ more unique write up per year

Full portfolio with diversified 50+ mostly EM/small value ideas.

Watchtlists in Koyfin with over 200 Emerging and Hidden champions stocks (free with Koyfin)