Emerging value updates #11

Thanks to all new subscribers, we are closing on 6500. It is an high number, but it has slowed down, I believe because the people are into pre-revenue stocks and AI bubble craze.

The price of the Emerging Value newsletter will rise to 200$ annual by the 15th of October. I recommend you capture the 150$ bargain price Forever before that. The monthly price will also rise to favour long term readership. These prices remain way below the average, while the newsletter provides great ideas that are proven to show doubles, triples and more, and limited downside due to the conservative business models approach.

My intend is to price the newsletter at a premium in the future, because it is uniquely positioned. So locking low prices forever is my recommendation.

Subscribe below for a complete coverage of emerging markets, hidden champions and very unique ideas with long term mindset. Iphone users: Upgrade from a web browser to avoid apple extra 40% fee.

—sponsor—

I use Koyfin for all my data analysis on stocks, graphs, and watchlists, and I have a 20% discount with my affiliate link here. It’s a product with real value for me. The free version is great too! I use long term views to see book value evolution and share buybacks, as well as revenue and net income.

I had a monthly update where I covered PayPal and JD mostly.

I covered all my Japan Stocks. although I am not a Japan expert, and will leave Japan to the expert, I keep a small Japan subportfolio. I may add new names, but outsourced to specialists like Asian Century Stocks,

andI covered all my French stocks with the best buys France, buy and forget. I may add more French names and I follow a few small caps. But I am constantly adding to existing names in the portfolio.

The main analysis for the month was Vinci Compass Partners. A very interesting company in the asset management space with exposure to Latin America.

I analysed my biggest Turnarounds, stocks that did not work out so far, provided updates in the last weekly update: This includes Intrum, CK Hutchison, Berentzen, Portmeirion, and a Asian real estate nano cap.

At the end of the week I will publish a deeper dive into Intrum, the Swedish debt collection company.

I stumbled across a new newsletter that I like, although I don’t share the same valuation methods. But what matters more is the opportunity discovery and business evaluation. I covered a Norwegian Hidden gems, The Middle east newsletter, and now this Australian one. All for Free, to give new people a boost.

The newsletter is about Australian Small cap value, and one of many articles that is interesting is about Swoop. Close the Loop is also interesting.

Value and opportunity released an article with an interview with someone who had a 100 bagger in Google stock (now Alphabet). I thought it was refreshing.

THE ANATOMY OF A 100 BAGGER – HOW A CANADIAN INVESTOR MANAGED TO HOLD GOOGLE FOR 21 YEARS

Inpost: A very interesting European growth story but with a conflict in Poland with a major e-commerce partner.

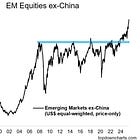

The case for emerging markets. Let’s say I agree fully.

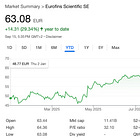

Bilendi by Quality value. Quality value is a reputable substack that was started in Spanish a few years ago, but now has a second English newsletter. It is recommended. I think that Bilendi is interesting.

Lastly, my partner and I released the part 1 of the PayPal analysis on the payments newsletter. We are two ex insiders, we know our stuff. So if you are interested in PayPal, it’s a must read. I have also enabled support payments on this newsletter, but it’s more like Buy me a Coffee: no extras. We are at 165 subs, let’s push this to 200+

I could do a best buys UK next, but it will be later, as I will restart in October with a new Deep value, hidden champions and quality best buys. Many of the stocks profiled moved up, so may no longer be the best value. I want also to look at stocks outside of the portfolio in my watchlist of over 200 names to see if some value appeared and do a complete check for value that has potentially appeared.

Thanks!

Thanks for the mention and vote of confidence!

Check out my latest buy ideas

https://open.substack.com/pub/buysidealpha/p/portfolio-update-september-2025?utm_source=share&utm_medium=android&r=69w6c1