Happy new year everyone and welcome to the new subscribers! Thank you for following and supporting.

It is time again for the Annual letter. Well, calling it an annual letter is a bit pompous, as I am not Terry Smith or Warren Buffett. So let’s say these are random thoughts.

This is very long, containing many reflections. Hopefully it will be shorter in 2026.

A full portfolio review is included + a new portfolio google sheet with updates links for premium subscribers.

The market and Nvidia

This market did very well, at least in the USA. I don’t think future returns are very good, but not everything is a bubble.

I don’t think that Nvidia is a bubble either. I think that it is unpredictable, and therefore uninvestable now, at least for the common investor. Earnings have gone up extremely.

I think that the earnings of Nvidia are likely to be in a bubble, a capex Bubble.

Unless the Nvidia customers can continue to make a good ROIC on their Nvidia products purchases, they will reduce or stop the investments. We see that the Nvidia customers, Apple and Microsoft, are pushing AI wrappers inside their customer experience. It does not seem to bring more profits by price rises, nor more customers, because everyone uses these companies already.

This is more Fear of missing out Capex, similar to 5g for telecoms.

I don’t believe they are making good ROIC on it. When Mag 7 say that they make good profits with AI targeted Ads and recommendations, I believe it, but guess what, this part existed before Nvidia. It was called machine learning and does not need Nvidia chips.

Google has been doing it 10 years ago: https://www.wired.com/2014/07/google-brain/

The Nvidia chips are used for next gen projects like GPT, Video and 3d world generation. While interesting, these bring 0$ so far to the mag7 now. Nobody is buying this, at least yet.

There is only so much Dollar you can extract from customers. GPT is text - provides real savings, but it uses less computing than video. So Chat GPT and Gemini have real use cases and businesses, but the Arms race we see is more related to next generation Image, video capacities, and trying to find general intelligence, rather than simple text output of GPT.

On top of that competition could come up with something better, and quickly. One good area for customers of Nvidia could be content generation by Netflix and Disney, if it allows them to create new animated movies super fast and cheap.

The rest of the small tech small AI plays market in the USA are in a pure bubble. Speculation is everywhere and it makes zero sense. It is 2021 again. 2022 is likely coming.

Too good results?

We see many many investors on X in the 50% or even 100% range.

One thing I find disturbing is large fintwit accounts going all around promoting nano caps aggressively. I think that it is more ethical to put these under paywall so the returns are more fundamentally driven and less stock promotion driven.

Growth and momentum investing can bring extraordinary returns, by constantly be in the “in fashion” names and dropping them when they disappoint. You can see that each year, it is a different set of names that are popular on X, and that the previously popular names are quickly pushed under the carpet and the authors want you to quickly forget that they promoted it. Celsius holdings or Fever Tree anyone, or Sea limited?

If you are into momentum and popular fintwit names, this is not the publication for you, but be careful with these promoters because you might be the last one holding the fintwit bag.

It is clear that conservative diversified value investing cannot really do 50% a year, but could do 10-15% a year, returns that are now considered low.

I resulted 14% this year and I am pretty satisfied with it, despite valuations still not improving. I would estimate that approx. one third of these are dividends, one third is earnings growth, and a small portion is a small rerating seen in some Asian names.

I see in the annual letters value investors clearly saying that they will switch to faster growth and event based trades.

I also noted that companies with earnings growth generated better returns in my portfolio versus the ones that have only boring 0-10% earnings growth. (Nowadays investors bias towards growth is so strong that a company is only interesting when it has 50% + earnings growth).

I have been adding more to growth names myself and a little bit to deep value names. However I am not selling any deep value names and I remain a valuation based investor. That means that a high entry earnings yield interests me. This has not worked well lately but this is a proven method to returns according to multiple studies.

To summarise, I don’t know if I will beat the market, I don’t know what the market will do. It is overheated for sure in the USA. I know that value investing will provide decent results (10% or more) at least equivalent to the earnings yield long term and some re-ratings of dividends. As a rational person, I can only work like this.

Adding to losers?

Adding just because a stock is down is a bit too much a tunnel vision effect. I should have considered all the investments and not mostly the ones who fell the most, instead of Adding to Bastide and Intrum with an anchor bias.

The good point is that I applied a strict process of not adding to the same name each month, which spread out the reinforcement across the whole portfolio and avoiding concentration bias.

I am positive on these additions of stocks in downtrend historically but I am sure that someday this will bite me.

It is sometimes a very profitable game, but comes with higher risk. Why not just add to companies without fundamental setbacks? I will favor this in the future.

But one thing is sure, the contrarian value strategy requires diversification, humility and only adding to the same struggling name every X months.

Trying to not sell: A peace of mind

I refined my investment style as a buy and hold coffee can investor. The coffee can portfolio comes from studies, or experiments, that showed excellent returns for some investors that never sold. (Although the story about the best portfolios being from dead investors is a myth).

By never selling, they ended up keeping some value traps or growth traps, but they captured the whole upside in the few growth gems they bought.

How many people bought and sold Nvidia, Microsoft, Alphabet or L’Oreal? Cathie Woods and Masa Son, the two most visionary growth investors in the world, or at least trying to be visionaries, sold Nvidia.

The best course of action was to buy some Nvidia, say “looks like they do some chips or AI thing But I am not sure”, and forget it and then buy AMD, and Intel, and the basket would do well. I don’t think that people could chose Nvidia over the others back then, but they could have put it in a basket.

The value traps will at least send some dividends that can feed this process, so not all is lost.

You can buy value companies and sell after a double or triple or more. It’s a skill to constantly recycle capital and be sure of the opportunity. It creates a mental strain to always think about selling or not selling. The number of decisions to make is in the 20s constantly.

Once I switched and stopped thinking about selling, my focus went more to what to do with the dividends received.

It was liberating and the decisions to make is about 1 at a time. Maybe 2 if you have a company going private and need to reallocate the cash.

Will I stay this course? I don’t know, because coffee canning will be difficult if things start trading at 35 times earnings, while other companies are at 3 times earnings. I will try.

However, this is especially important to do it with quality and growth companies. It may limit your return versus a very skilled stock flipper, yes. It also brings you closer to the essence of investing.

Really, it depends what you want to do. Have the highest CAGR% or have a decent one and feeling more relaxed. Probably, I need the relaxed approached to investing and I enjoy being a long term holder.

It also allows me to get longer holding periods and better knowledge of the companies.

Rediscovered various role models

Masa Son and Tom Gayner are examples, and Buffett of course. All three give lessons in buy and hold.

Masa Son because he spreads his bets in Tech without concentrating, and he held on Alibaba despite having probably hundreds of losers. And he is as a counter example for Selling Nvidia and I think now Alibaba too. I like that he simplifies growth investing to the maximum. If he believes in the use case for the customer, and that the company is a leader product wise, he buys. Zero valuation work. This is growth investing. I am not becoming a growth investor, but I like the mindset of letting the future happen once you believe in a company.

Buffett because he has unlisted investments that maybe are not growing well or not fantastic, but he takes the dividends and places it elsewhere. I don’t think he cares that Nebraska furniture mart or some railway is a value trap. It’s cash flow being reinvested. Because it’s unlisted, nobody says to him, “When are you selling this value trap?” It’s strange isn’t it? But if it is listed it is a value trap? If it is listed and provides good dividends, it’s fine to me.

Tom Gayner because he can buy Lowes or Deere, two “value” companies, and hold Alphabet and Amazon. And he will probably never sell these. He is able to hold, and to buy completely different things. He thinks very long term.

Holding is the key I learn from these investors.

I think this kind of long term thinking is appropriate for the personal investor that does not run other people money.

Reflecting on Mag7

As a value investor, I reflected on reverse engineering the Mag7 success. It’s a lesson for all of us.

So the people who made good returns on these companies, just bought them because they seemed dominant and forgot it.

For sure they also had many losers because they bought all the Rokus and Peletons, plus Alibaba, and potentially future losers like Palantir or Nvidia.

But if they stuck to the FAANG they would have done very well.

I remember buying Ebay (PayPal) in 2010 with my company purchase plan, and not buying Google. Why didn’t I buy Google?

First, I was a newbie investor. I did not buy Google because I could not figure out how much it could grow. Everyone was already using google in 2010! Sure, there was not much Youtube or cloud but we all had google. For PayPal, I understood the TAM, the growing penetration of payments, etc.

For Google nothing. I thought that maybe the full potential is reached.

If I had been dumb, I would have said “Everyone uses google” and just bought. The P/E was like 12.

zero analysis needed.

Lesson: Just dumb it down+ never sell. The dumb big picture analysis is more accurate than attempting to judge the market size in 10 years.

This is why I bought Alibaba and JD this year. My analysis could be summarized to “China Big and Strong, Alibaba and JD oligopoly”. While specialists of China were analysing how Alibaba was losing market share on the sale of items in tier 3 cities in inner Mongolia for the 30-45 years old demographic, they were missing the full picture. E-commerce is just a website with network effects and delivery. Therefore it will evolve with competition into an oligopoly. If you have 30-30-40% market split, it’s impossible that one goes and takes 90% of the market, because the other two companies have thousands of employees working around the clock to compete and counter strategies. Don’t believe the hype about this or that CEO being so good that it will steamroll the competition. It cannot make that much of a difference.

The lesson part 2.

What Mag7 can I buy next? What other big tech can become like a mag7? Uber and Mercado Libre come to mind. I used Uber extensively, even though it kind of is a bad experience. Should I simply add to Alphabet and Alibaba, maybe?

I open myself to this possibility in the long term, but at the moment I see too much value in small caps. I will keep pounding on value. When value becomes expensive, I will change.

Good performers and bad performers

One good point was to time the Chinese tech very well in early 2024, a fully contrarian trade. Of course the bet was small in percentage, but a good few thousands it was. From a trade an investment with a large time horizon is born. Nowadays the equivalent is clearly Brazil. This is not investment advice but for sure Brazil is the China of early 2024, hated, all times low, communist, etc, and it’s always the same people bashing at the bottom. The scared fear mongering type. Investing is for optimistic people.

I also bought a Euro Bond ETF which provided more income that was reinvested into stocks, and that I plan to liquidate when it yields back 0-1%. Pretty good place to put money to sleep. This is not included in my reports.

Terravest, a Canadian Industrial Serial acquirer, was the best performer, a combination of good acquisitions and favorable demand for their cyclical products did well for the company which was cheap. EV/EBITDA is now 12 and the cycle is still quite up, so I am less positive about the company short term outcomes. I still hold as per my process, and I could expect some year or two of consolidation for the company to grow into the valuation. Long term, it is a great company with good management. As of Jan 3, I am up 293%.

Beenos, a Japanese ecommerce company, was a great performer, but I was only up about 40%, because I bought before 2024. This was taken out. The Japanese tech company sold a non performing division and is proposed to be bought by Ly Corp.

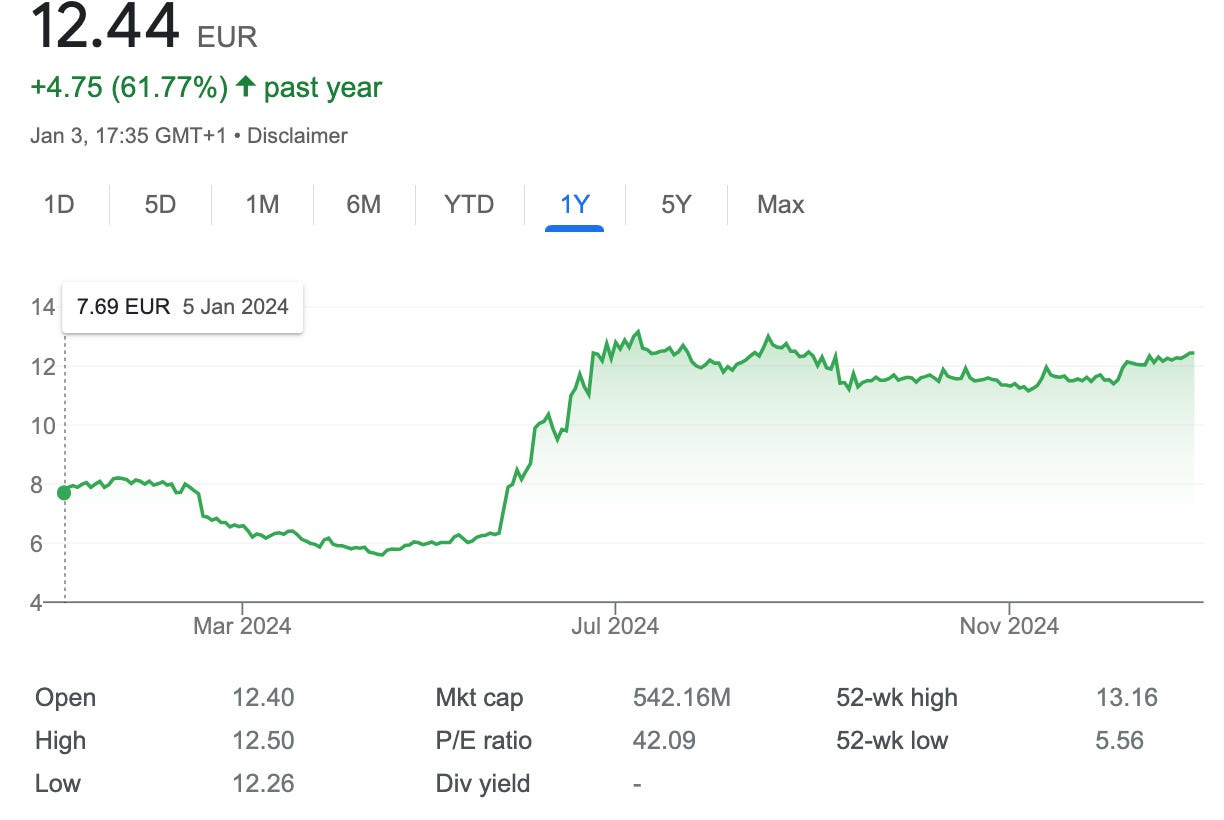

Newlat, another serial acquirer from Italy in the food industry, explains this maniac market. The company was trading below 10 times FCF during spring 2024, because this market does not care about valuation. But since it executed on a growth acquisition, it became cool again, and rose back to the new valuation. It remains attractively valued due to the extra earnings post acquisition. This shows that this market only cares about growth and catalysts now.

Another serial acquirer with good results in 2024 was UK based Supreme PLC, with the same pattern. No regards for valuation until the acquisition catalysts came in.

Other good performers: Alphabet.

First Pacific in HK is one of the rare stocks going up without catalysts, yet valuation remains low. very low. It’s finally one of the 5 companies now up over 100% with dividends included in the portfolio.

Other than this, most of the portfolio did not much, stable returns, no rerating, no crash. This explains the global 14% return of the portfolio. Here this would be any movement under 25% up or down, which I mostly consider noise, although appreciated noise if it’s 25% up.

Now the losers.

Text SA, ex Livechat, a Polish tech company, had some bad results in terms of customer acquisition for the main product, compensated by higher prices and cross selling to their other products like Knowledge base and Chatbot. This was caused by a weak economy, especially in Asia, and I think too much price increases. This is not looking like a tech disruption. I remain cautious and do not add new capital to Text until the matter is clarified. On the bright side, they keep coming with new products, including a slack clone. A webinar today should give more insight about the customer base development, and I am not very optimistic.

Bastide, a medical service company, had a wild ride, with a Panic down, especially that people learned that Legendary fund manager Williams Higgons was selling. I stuck to my conviction and added. He sold and made the bottom with his volume. Little did they know that Williams Higgons has a momentum factor in his selling decisions and was not acting on fundamentals, which were bad, but not that bad. Never follow a guru blindly.

Berentzen Group, the German drinks company, went straight down, while performance improved fundamentally with large EBIT growth. Ah Germany! Destroying value investors in 2024.

The winner of the losers is Intrum AB, the Swedish collection company. They have just passed their prepackaged chapter 11 and should come out much stronger and without dilution. I commented that the stock and bond price panic made no sense. Dissenting bondholders were fighting the chapter 11, arguing that their economic model showed that Intrum was not in financial distress. I agreed, but due to bond ratings and regulations, it could not refinance itself for a while. Maybe I should not have added. I stay disciplined and will not add more to a name in distress.

You can see that my full write ups represent only a small part of my activity and holdings. I aim to remedy this with maybe some quicker short thesis.

Full portfolio and 3 new positions presented + exclusive spreadsheet will all companies and updates links below.

Due to three positions taken private recently, I have opened new positions.

One is a dominant EM retailer barely mentioned at 9 times forward PE but with challenged macro. (I ignore all macro - following Buffett’s advice).

Two are cheap Japanese growth companies with good fundamental metrics. These Japanese smalls are quantitative/qualitative bets and are rarely mentioned.

.. details below