Dlocal is a company we have covered in my Paymentsinvest newsletter with my friend Bright.

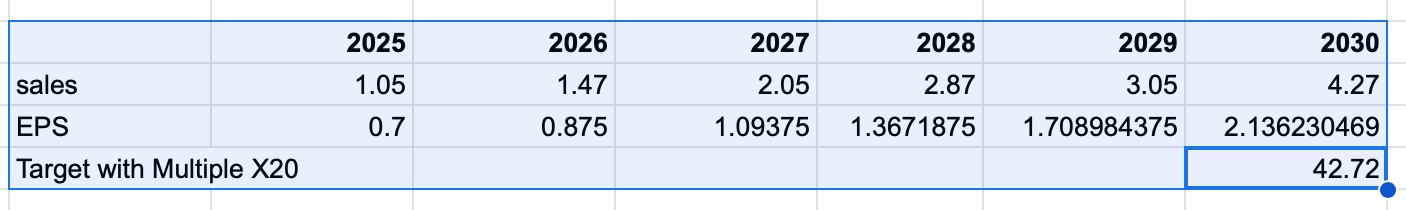

Let’s summarise: A payment company that facilitates payments in emerging markets for global merchants. Trading at a forward P/E of 17 and growing revenue 40% Yoy and EPS 30% Yoy.

There are many posts or write ups that are very bullish, but this is just looking at current numbers and earnings presentations.

Instead of just taking the copy slides from the powerpoint deck and be super bullish, I decided with by friend Bright to get an industry insider perspective on Dlocal and challenge the consensus bullish view and look at the real perspectives of the business.

First, we covered the bullish outlook:

Then, we covered the bearish arguments.

However, after this discussion, I came to the conclusion that this was not going to be enough to understand Dlocal enough.

If I was an regular writer, I would put in place an excel model, drag a formula to the right, and include some quotes from the CEO and talk about Total addressable market, add a 20 multiple and the research would be done.

But some key points need to be analysed with focused research:

So I decided to write another premium article where I focus on mapping the list of merchants already using Dlocal, the potential for more merchants, the real market size (and not the one from the investor presentations) and some key points around geographical expansion.

This is not going to be perfect, because we are operating under incomplete information, but this is a honest attempt at really understanding an opportunity.

Introduction

Dlocal is an emerging market payment company. It helps global merchants with receiving payments from customers that are in emerging markets.

This is a very fast growing company at 17 times forward earnings.

The key problem is simple; many times, when emerging markets consumers want to pay US merchants, they encounter problems:

Their card gets declined

Their card network is not enabled for international payments

Their subscription rebill gets declined

They don’t have a credit card

Their mobile wallet is not offered.

All of this, makes lost sales for the merchant as the buyer simply is not able to buy.

Enter Dlocal:

You sign a contract with Dlocal, you choose if you want local currency payments or if you want the payments to your US (or Europe) bank account in your currecncy.

Dlocal takes care of the rest. They connect with local banks to make sure that you receive the payments with the highest success rate and that you offer all the mobile wallets (Alternative payment methods or APMs). They receive the funds and send them to you, all for a fee. You do not have lost sales due to payment problems.

Dlocal was started from Uruguay when the founder could not pay online at a US merchant. He built a solution to accept a local Brazilian payment on one side, and send an international payment to the merchant on the other side, while collecting a fee in the process. Dlocal was born.

Below is my review:

1-Check the customer list and see the potential for large wins

2-Name the large merchants left to win

3-Estimate their Latin American potential revenue from this client base

4-Compare Dlocal versus Adyen

5-Growth outside of Latin America

6-Conclusion on long term growth outlook and if I kept, added or sold Dlocal.