Since I published my article presenting CK Hutchison, I wanted to dig deeper into the retail segment AS Watson which is important to the thesis as it represents 28% of group FCF.

For new subscribers thanks for joining the fun! The thesis is here:

Usually when investors hear the word “Retail”, they run away, me included. Retail can go from great to bankruptcy in an instant (Destination Maternity for example).

However AS Watson is different in that it focuses in Health and Beauty small format.

It started with a Hong Kong Dispensary formed in 1841 as the first drugstore in Hong Kong to offer western medicines to customers.

A.S. Watson enters the European market in year 2000 with our first acquisition of Savers health & beauty retail chain in the UK, followed by a number of acquisitions across Europe, bringing Kruidvat, Superdrug, Trekpleister, Drogas, Rossmann, ICI PARIS XL, Marionnaud and The Perfume Shop into our family.

Health and beauty is more resistant to online as customers like to browse and try products in beauty, and get advice in Health, or buy things immediately if they need a health product. This is despite online delivery getting faster and faster in large cities - maybe at some stage it will compete with walking to the local store - 30 minutes. The good thing is that Watson is providing such fast delivery services.

AS Watsons can use the store and membership as a competitive advantage, even if tiny. A user could also use a competitor online shop if they always repeat the same product order, but go to Watsons to browse and chose specific ranges.

Brands:

Watsons:

Watsons is Asia’s leading health and beauty retailer, currently operating around 8,000 stores and more than 1,500 pharmacies in 15 Asian and European markets

Size: 8000 stores + 1500 Pharmacies

Geography: Asian mostly + Europe

Online: Online store + owned brands

There is also “other retail and others” subsegment and that includes a beverage business that AS Watson owns in Greater China.

Kruidvat:

1,250 stores in the Netherlands and Belgium. Health and beauty and electronics

Geography: Belgium + Netherlands

Online: Online store + owned brands

Trekpleister

200 stores Netherlands. Drugstore

Online: Online store

Rossmann

Health and beauty retail

4000 stores

Geography: Germany, central Europe

Online: Online store + owned brands

Superdrug

Health and beauty retail

800 stores

Geography: UK

Online: Online store + owned brands + plus online drugs ordering

Savers

500 stores

Geography: UK

Online: Online store + owned brands

Drogas

120 stores

health & beauty

Geography: Baltics

Online: Online store

ICI PARIS XL

290 stores - Perfumes and cosmetics

Geography: Benelux

Online: Online store

The Perfume Shop

230 stores - Perfumes and cosmetics

Geography: UK

Online: Online store

PARKnSHOP

280 outlets - Supermarkets

Geography: HK

Online: Online store

PARKnSHOP Yonghui

Launched 2019 - 80 outlets - Supermarkets

Geography: China

Online: Online store

Fortress:

70 shops. Electronics. HK + Online

Watson’s Wine

Dozen of shops. Wine. HK + Online

TASTE:

10 supermarkets, Hong Kong.

Ecommerce business or “O+O”:

I tried to find references in Articles or Publications to the size of the Ecommerce business of AS Watson but could not find any. Usually if you cannot find this information, it is because it is very small. And indeed it seems to be the case, judging from the following information from 2020.

In China, temporary store closures peaked at around 2,500 stores in February with an 78% year-on-year sales reduction with 62% stores closed.

We can assume a very low online sales mix then. With that said, Ecommerce business increased 90% in H1 2020.

In the H1 earnings call we got some information on the size of O+O:

A.S. Watson, we have nine --only 9% of our customer base is O+O. So, there's huge potential to convert them to do O+O.

So right now I think the O+O sales participation is around say 18% for the group and for health availability is 21%.

And then, the growth this year was about 30-plus percent.

If I may also mention about China, I think the question also covered China. In terms of China, O+O sales participation reached 40%.

For O+O china I think that they include Wechat marketing and not only online buying. China is 16% of total Health and Beauty sales, which limits the disruption risk. China is a very very competitive online market. I was a shareholder of JD.com. and I learned that. Less competitive Europe is 53% of sales.

As Watson calls the evolution of their retail offering as Online+Offline or O+O.

A.S. Watson O+O retail is an ecosystem that is powered by technology, big data and artificial intelligence, not just about having physical stores and also an online store. Different from traditional Omnichannel or O2O model (online to offline or offline to online) from the past generation that drove customers from one channel to another, O+O retail is more about creating an integrated offline and online experience to better serve customers’ needs through digital transformation, that enables them to shop across any channel, anytime, anywhere.

Sounds a bit gibberish. It is explained a bit further below:

100+ eCommerce platforms, and very importantly, the customer connectivity with our base of 139 million loyalty members. Capitalising on the in-depth and sophisticated customer insights, we are able to provide the most personalised O+O experience which not only delivers the best offer to our customers, but also growth to our business

Let’s see that in examples:

Online advice

Giving an example from China, where customers can seek personalised advice from in-store beauty advisors via Enterprise WeChat and enjoy one-to-one customer service.

She explained that the advisor can recommend personalised product offers with the help of an artificial intelligence engine, help order the products from its cloud service MyStore (a WeChat platform tailored for A.S. Watson) and customers can receive product delivery within one hour.

Using membership insights and network to launch a new brand

“P&G (Procter & Gamble) Group and A.S. Watson Group jointly announced the new launch of a co-created Japan skincare brand aio in the physical and online stores of Watsons in the Greater China markets.”

AR app to try cosmetics

ColourMe Reaches 33 Million Try-ons

In Asia, ColourMe – available in Watsons Hong Kong, Malaysia, Thailand, Taiwan, Singapore, Indonesia Vietnam and the Philippines – uses augmented reality (AR) technology to instantly and virtually show customers how they would appear with different looks, as well as making product recommendations.

Skin care in app

Superdrug’s customers in the UK can now take a selfie and answer some simple questions to receive personalised and in-depth skin analysis, as well as a bespoke list of product recommendation on mobile device. Since introduction, Superdrug has seen an over 20% increase in average order value and over 100% improvement in conversion rates. Riding on the success in the UK, the AI Online Skincare Advisor is expected to roll out in Asia in the first half of 2022

Performance of the Retail segment.

In Asia were half of the stores are located, the comparable stores sales growth has not recovered the sales lost during the early pandemic (-29.2% then +17.8% in China, -18.5% then +1.1% in the rest of Asia) especially in the rest of Asia.

In Europe and the rest of Asia, footfall in a number of countries where the division operates was adversely impacted by lockdown measures imposed intermittently throughout the first half of 2021.

In Europe it has recovered.

As a result, the division posted EBIT of HK$ 4939 in H1 2021, versus HK$ 2970 in H1 2020, and HK$ 6590 in H1 2019.

The company is still opening new stores (+2% in 2021) as it expects positive ROI overall with a payback period of 12 months.

So we are not out of the woods yet and the pandemic still hurts the retail segment. Maybe it was a permanent decrease in earnings to a lower base.

Same store sales pre Pandemic

We can see in the table below that It is doing fairly well. One area of concern is China, with declining SSS in 2018. The company says it is because of new AS. Watsons stores competition if I understand right.

China is a small part of the revenue.

Market

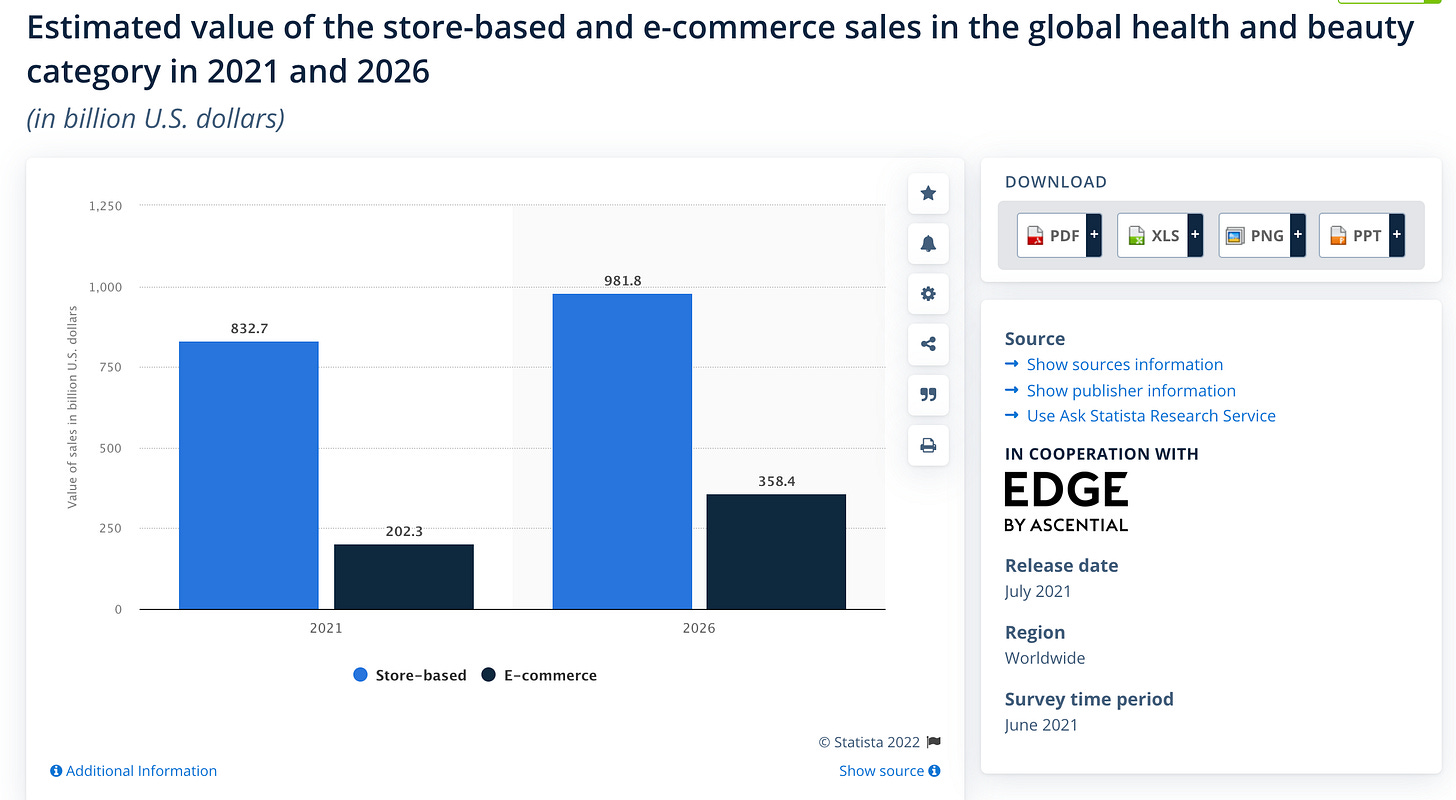

This estimate by Statista research shows global in store sales growing slowly to 2026 and ecommerce nearly doubling.

A more detailed report is here

Prospects:

As noted in the H1 earnings call, opening retail stores is the second priority of CK Hutchison in terms of capital allocation, and this speaks of what the company believes the prospects are, ie pretty good.

NEWS:

A.S Watson is bringing Marionnaud to China with collaboration stores. Marionnaud is a leading perfumes and costmetics chain in France and Europe with 830 stores, owned by CK Hutchison, but for some strange reason not included in the retail segment.

but in Others: https://www.ckh.com.hk/en/businesses/others.php

Joint Launch of skin care brand with P&G: https://www.aswatson.com/procter-gamble-and-a-s-watson-group-co-create-a-new-japan-skincare-brand-aioredefining-simplicity-and-sustainabilityexclusively-available-at-watsons/

Conclusion

The retail segment is defensive but the pandemic decreased it earnings to grow from a lower base.

The future growth rate is a bit uncertain, depending to which level the own online retail sales will cannibalise the store sales.

Opening of new stores will provide growth at the new unit level because new stores are profitable. We can hope for more sales recovery in H2.

The company is well managed and innovative on O+O and brand partnerships.

Long term I am not worried about the competitive position. Only in China could online really hurt the business thanks to fast delivery times and large competitors. But then again, AS Watson is good in online delivery times in China.

The retail segment online presence seems competitive in terms of store design, shipment times and membership program + has the in store experience as a bonus so I view the company as well positioned to capture some of the E-commerce growth.

The limitations of this review is that I am not on the ground in the countries where it operates, and I am not a retail expert. Predicting consumer behaviour is generally very difficult.

Because the whole of CK Hutchison trades at a 5-6 PE ratio, the only thing we need from the retail segment is that it is not a melting ice cube like Sears or JC Penneys. As expected before this deeper dive in my analysis of CK Hutchison. Due to the type of products sold and the small Health and Beauty store format, it is defensive retail and it does not hurt the CK Hutchison thesis. Value investing protects the downside by not paying for potential growth.

I also want to do deeper research on the infrastructure segment, for which I will probably write an article. The management is positive about it, but I want to understand better why.

Before that, I am preparing an article on a fantastic French company I mentioned several times on my twitter @returnsjourney

More on AS Watson digital transformation:

https://www.ckh.com.hk/upload/attachments/en/journal/Sphere_47_e_ASW.pdf.pdf

The story began in 1828, apparently! https://webb-site.com/articles/watson.asp

Thanks for a great write-up. Currently researching CK Hutchison as well.

Good write up.

I personally prefer CK Infra. One issue that complicates the CK franchise for me is the cross ownership. How do you think through that problem and opportunity?