Introducing the best buys.

I have a problem.

I have a very diversified portfolio of various stocks in three main categories:

Deep value,

Hidden champions,

Quality

Even some Growth

On top of that we have different geographies, large caps and small caps.

How can a subscriber have a clear overview the portfolio opportunities I write about easily? It is very complicated. I received this feedback.

How can I share the result of my years of global watchlist building?

⭐️By providing weekly lists of rankings within my portfolio, and also maybe outside my portfolio as the watchlist is be interesting.

✅ These rankings will show you the cheapest, or the best, or most interesting stocks.

📑 It will also help covering earnings and updates on portfolio companies

So starting now, each week, I will make a summary email with about 3 to 6 companies in a theme. On top of that It will contain the ranking, the current valuation and news about the company.

Each week, you will get some of the best opportunities in the market. Not catalyst based, not momentum based.

Value and Growth at a reasonable price. The Warren Buffett approach.

“I don’t focus on catalysts. I have always felt that value is its own catalyst and that eventually the stock market becomes a weighing machine and will weigh stocks correctly. “

Monish Pabrai

To start the series, I will focus on the main themes of my portfolio framework. Then I will continue with thematic themes such as industry or countries, and regularly come back on the main three frameworks.

Today the theme is Deep value:

These are names that are really cheap, but are not especially growth superstars. They should rerate and continue to produce capital until then. This list excludes turnarounds. Turnarounds are still fixing their issues.

At Emerging value I aim to be the reference in highlighting where the value is, no matter where in the world.

For this deep value series I have excluded energy companies. I also exclude companies with hidden value provided from a building or land somewhere.

No; pure really low earnings multiples.

Let’s go!📎

6-GRUPO AVAL

Value score: 3/5

Defensive score: 3/5

Growth score: 4/5

Grupo Aval (NYSE Traded) is a major banking and wealth managment group in Colombia. Emerging market banks do not function like develop market banks. They are more resilient, used to inflation and devaluations. Also they have more structural growth and are prone to economic booms when the cycle turns.

Earnings took a hit with lower deposits (funding costs) and higher impairments has Colombia was hit hard with the depreciation linked to the speculative bubble in the US dollar and the resulting inflation. (correcting now as the USD was too overvalued).

At 0.8 Book and 6.2 times forward earnings, it is the most expensive stock of this deep value series. It pays a good 4.5% monthly dividend.

As Latin American specialist writer

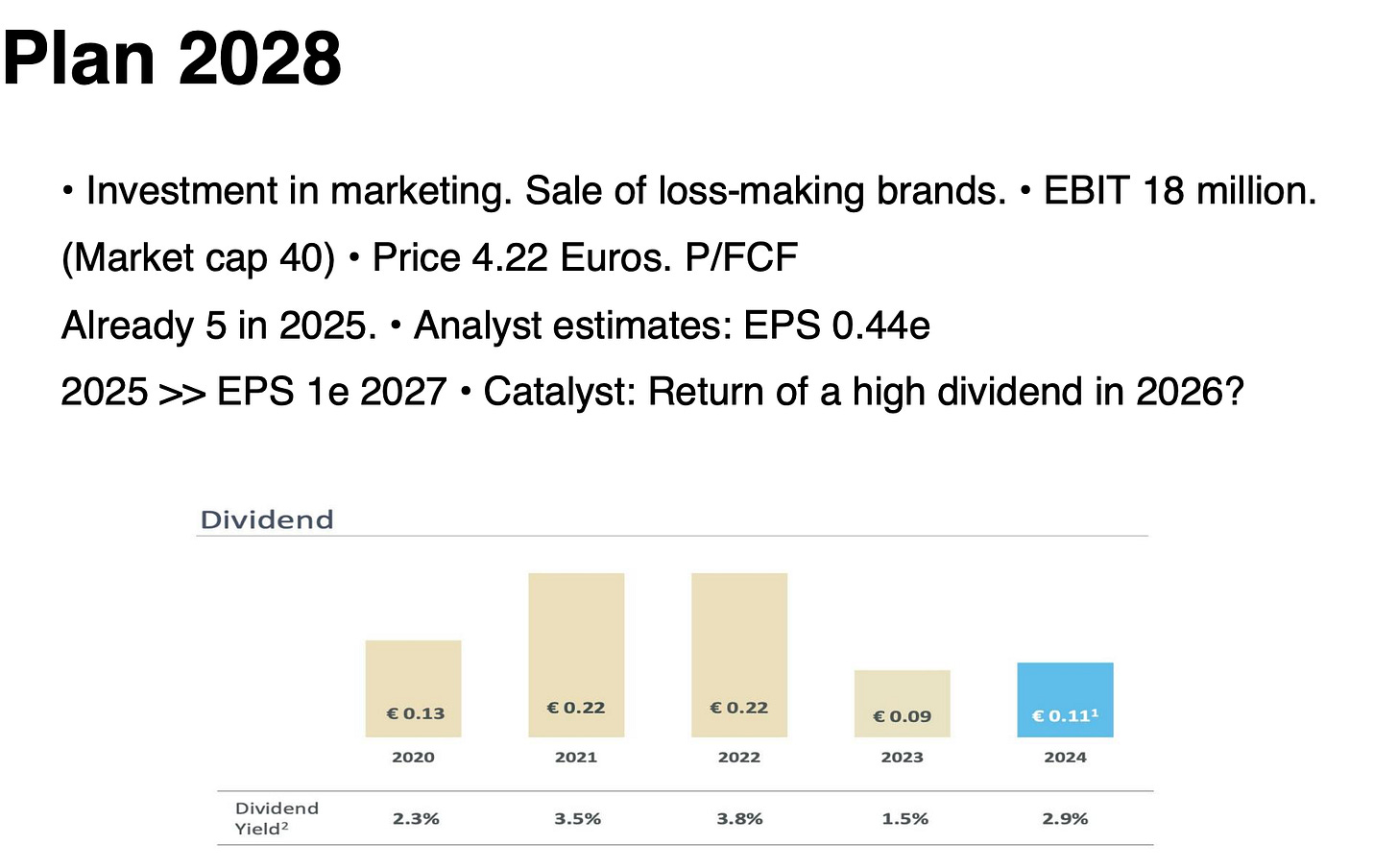

notes, Colombia is likely to go from Far left to right wing president next year. This would change the currency, valuations, and investment cycle.5-BERENTZEN GROUP

Value score: 5/5

Defensive score: 5/5

Growth score: 2/5

This beverage and drinks company micro cap out of Germany does not screen well. But I have looked at the accounts in great detail. There are many non cash adjustments. It trades at 5 times Free cash flow. 0.2 times sales. It produces cash, but there is some working capital and inventory build up that is limiting the real free cash flow. However, everything eventually reverses.

I made a French video about Berentzen for a new youtube channel. The key points:

No revenue growth because Berentzen is selling down/cutting low margin segments.

Good profit growth

A hidden gem inside Berentzen is the limonade brand Mio-Mio which is worth the market cap since it is a fast growing fashion drink.

Berentzen has launched its largest Mio Mio marketing campaign to date: Schmeck (taste) This out!

To Summarize we have a market cap of 42 million Euros, my adjusted FCF is 8 million, and sales are 181 millions. This makes a Price to FCF of 5

A Catalyst for a rerating would be higher dividends in 2026.

❗️❗️

Not yet a premium subscriber? Join the premium version by clicking the button below.

There is a special discount on the annual membership.

I shared many ideas in the past that proved winners:

Examples:

When I called and caught the bottom on Alibaba in early 2024. I am a contrarian who can analyse when investors have abandoned all hope and when valuations are perfect for investing.

Number 4 on this list, revealed below, is up 76% in my portfolio, after falling and recovering, then shooting higher. I have actually added cautiously when it fell, because value was incredible. It trades at 5.2 times earnings still and is expected to grow earnings over 20% per year. Of course, I take these estimates cautiously. But I hold and at this price we do not need growth.

Number 1 on this list is up over 100% since the start of my newsletter, pays me huge dividends, and trades at 4.2 times earnings. It remains the cheapest. it paid me a dividend last week, and I am about to reinvest it in a Tech company at an insanely cheap valuation too.

Thanks!!

✅ Lets continue with the list: