Berentzen Group is a German hard to read liquor and soft drinks producer small cap that is deeply undervalued on P/Sales, P/cash flow and EV/EBITDA. Let’s analyse.

When you mention the company to German investor they all are like “what? I did not know that Berentzen was listed” and remember fondly of times drinking the Berentzen probably at some party outdoors. It seems that it is a niche drink.

Brief History

1758 - First record of a Berentzen company in Haselünne.

1758-1960: Drinking Berentzen and having fun I think.

1960 - 2014 : Pepsi bottling concession

1990 - Pushkin Vodka brand bought.

2008: The company was making losses for a few years now due to family infighting, mismanagement, leading to a take over by german turnaround company Aurelius. Aurelius buys distressed assets and turns them around by cutting costs and improving processes.

2014: Bought Citrocasa, a fruit juice machine company

2016: Exit of Aurelius.

2020: Bought a small cider company.

Let’s have a look at the long term numbers:

It does not look impressive. We can see that the revenue and profit was growing slowly but steadily prior to covid (2016-2020), except a bump in one year. This is while low margin contract bottling business was progressively exited. Then covid hit, we can clearly see 2020 and 2021 down. Then sales rebounded and inflation hit the bottom line.

Business overview

The company makes over 170 million Euros of revenues, and has several plants across Germany. The market cap relative to revenue is low at 60 millions.

Spirits Segment.

A majority of the business is Spirits (59.7% of revenue). This part is also quite capex light with solid pricing power.

You have the traditional German drinks like Berentzen and Pushkin Vodka.

These owned brands spirits represent 33% of segment revenue. It grew 25% in H1 23, mostly with pricing power and a bit of volume.

Then, for 66% of segment revenue there is some innovation in new private labels or new brands in Rhum, Gin and Whiskey in cooperation with supermarkets. This did not grow revenue significantly in H1 2023, growing by 8%. The management attributes it to temporary bottlenecks.

There are some collaboration drinks with celebrities that bring occasionally some growth, Berentzen bringing the capacities in manufacturing and the celebrity helping with marketing.

This segment is the cash cow of the company with good returns on capital and low reinvestment needed. The company has extensive production and distribution capacities.

Non Alcoholic segment:

This segment represents 25.6% of revenue.

From this, about 44% of the revenue is Mio Mio, and 44% is other brands of mineral waters/ juice/ lemonade.

Mio Mio here is the growth part of the company, but it is only 11% of sales. Mio Mio is a mate soft drink which is kinda “Cool” and growing fast. Mate is a South American drink that is kind of like Cafe and Tea and Caffeine rich.

Mio Mio is now a modern drink coming out in all flavors possible and most likely using the Mate ethnic style just for marketing, and is not tasting much like mate.

Berentzen group has been historically doing contract bottling with soft drink companies. This is a low margin business that is being reduced and was exited over the years, as we can see in the chart below:

In the graph below, we have non alcoholic segment revenue, gross margin and contract bottling revenue:

We can see that Berentzen exited Contract bottling, which makes revenues look bad, but in terms of contribution margin, has little effect. Additionally, the covid sales drop also made the company screen bad in terms of sales growth.

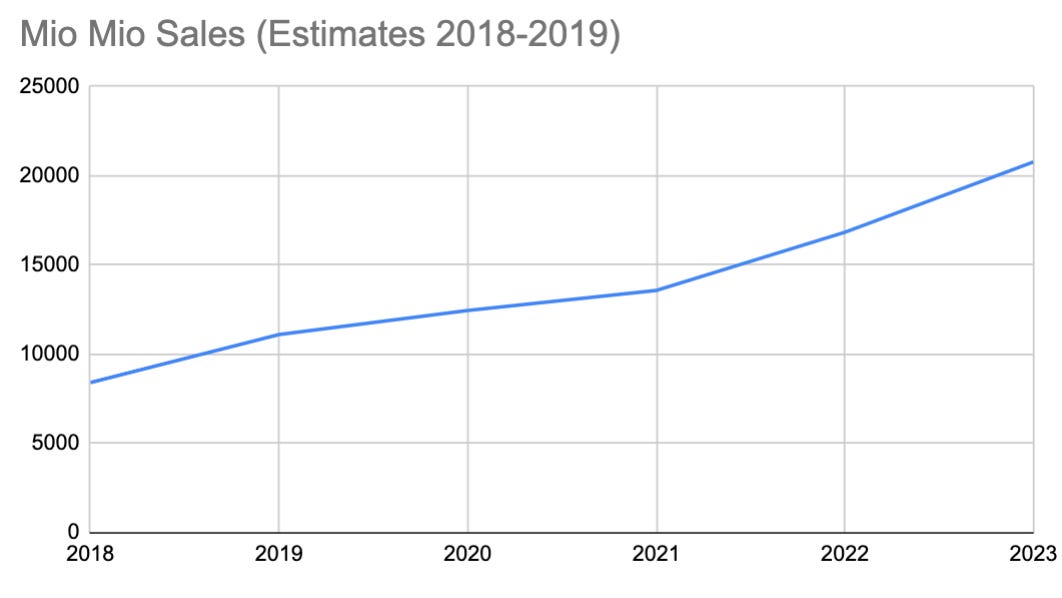

The focus of the company is Mio Mio, that is visible in the Capital expenditure. The sales growth is real for Mio Mio, where I reconstructed the 2018 and 2019 sales as estimates because the company changed the reporting method from bottles to sales.

During the last conference call, the company views MioMio as having continued double digit growth from more distribution and more flavours in stores.

Fresh fruit machines

10% of revenues is the fresh fruit machines and refill segment. This segment is stable. It was bought as a growth segment but it is not really impressive in terms of growth as it is not growing. The capital allocation of this purchase was probably not the best. Berentzen offers machines, refills, maintenance in one package and is optimistic on future growth.

Maybe it was hurt by covid and will start growing again, as it showed growth of 9% in revenues in H1 2023.

https://hscie.com/transaktion/berentzen-gruppe-ag-acquires-tmp/

Other segments: We have a Berentzen Museum experience and a Turkish sales to the tourism industry segment. These are kind of small but contribute to the brand presence, and some profits.

Lets review Strategy, Management, Market, valuation, and capital allocation below: