Hello !

Let’s travel back to Europe this time with Ambra.

Ambra is a Polish company. It was founded in 1990. in 1994 Schloss Wachenheim AG became a minority shareholder of the company.

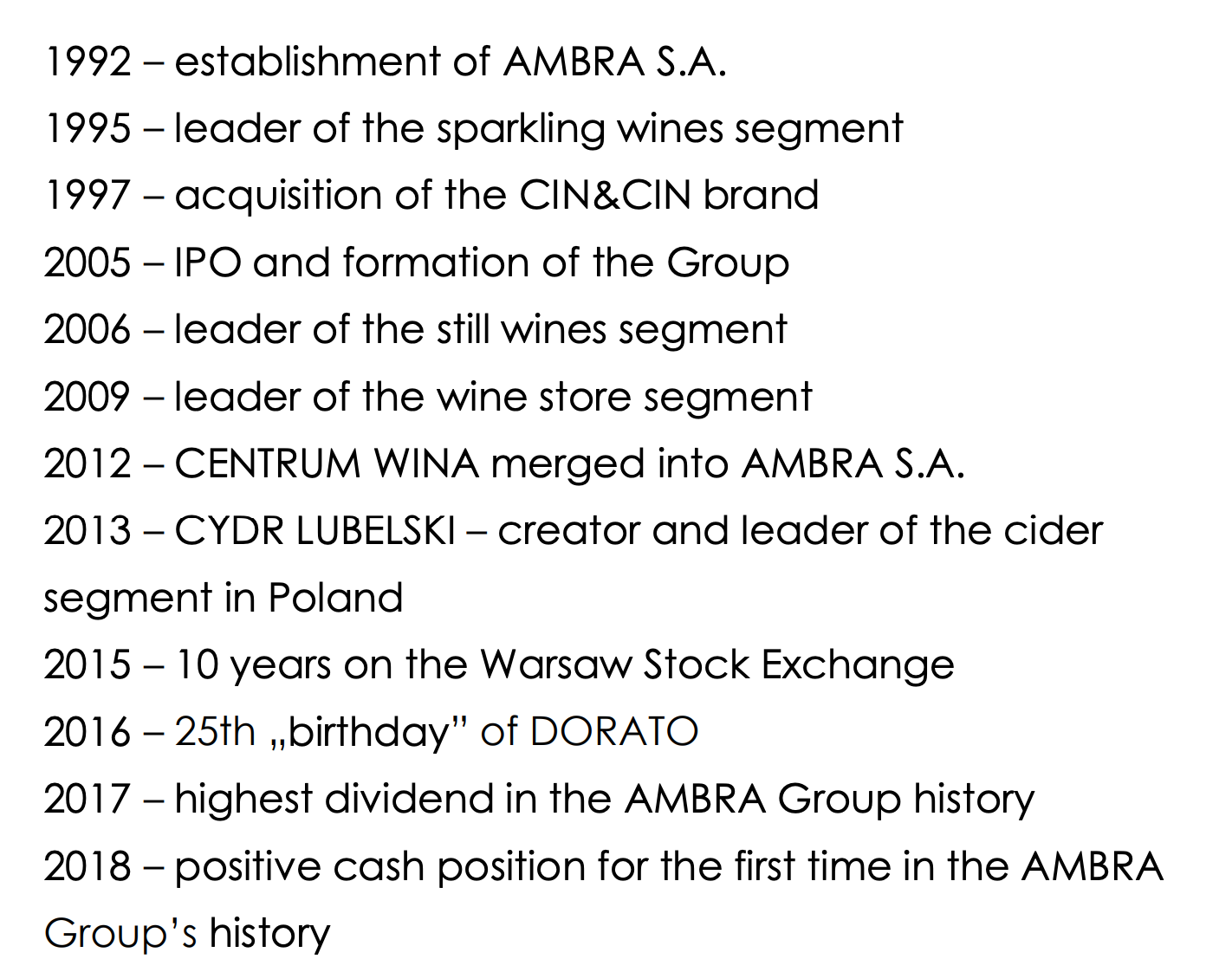

Here is the history from their website:

July 2019, SANGE DE TAUR brand was acquired.

The Chairman is Robert Ogór, who was at Schloss Wachenheim AG for 10 years, and “In July 2003, he became the Vice-President of the Management Board of AMBRA SA, and in February 2008, he was entrusted with the function of the President of the Management Board.”

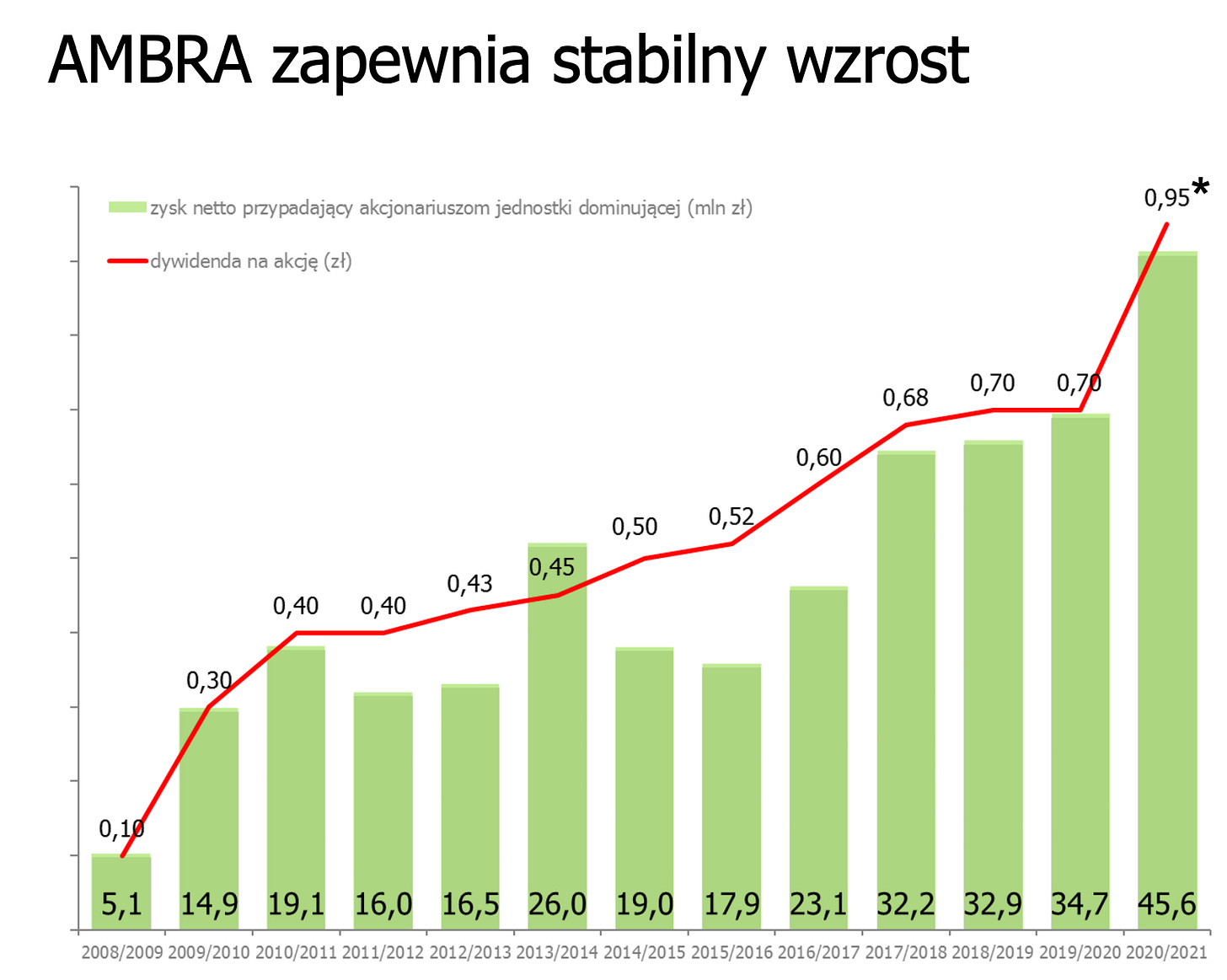

In the past 7 years, the net profit went from 19m to 45m Zlotys, the dividends from 0.5 to 0.95, growing every year. It was slow and steady. The stock price went from 10 to 25, a CAGR of 14% ex dividends of about 3% a year.

Overview

Today, AMBRA Group is a leading manufacturer, importer and distributor of wines, mostly in Poland, but also in the Czech Republic, Slovakia and Romania. 73% of the Group's revenues are generated in Poland.

Half of the sales are large branded products like sparkling wines and liquors with large marketing pushes. Then they sell third party made wines, mostly imported.

The company has 34 wine shops in poland: https://www.ambra.com.pl/centrum-wina/ , and recently acquired some retail stores in the smaller markets.

The company has a wine loyalty club and community at http://centrumwina.pl/kocham-wino/ , the biggest in Poland with over 200 000 members.

Market overview

Wine benefits from growing tailwinds in these countries:

The Polish wine spending is constantly growing. It is actually shifting a bit from beer and hard liquor to wine.

Polish wine consumption is still way behind European peers (a bit old but the situation is clear):

By the way a similar situation is found in other sectors in Poland, and this is what can make Poland an interesting stock market.

Strategy.

So How they did they grow?

Small acquisitions.

Control some of the retail distribution, and good Horeca distribution

Launching of new products : See below for pictures of products launched in 2019 to have an idea of what they do:

a party drink for kids

a wine made in Poland

an alcohol free drink

The negative side is that they don’t operate with debt enough and they are not aggressive in buying companies to expand. The positive side is that they are really careful with expansion: It needs to fit their business plan, and it is not just acquiring to increase revenues.

Recent results and valuation

The last results were excellent.

For the full year, net profit was up 31% and sales up 14%. It looks like it was an above trend growth, led by marketshare gains in Romania and Czech Republic, and good development in Poland.

For the first quarter, it was even better, the net profit attributable to the shareholders of the parent company amounted to PLN 11.0 million and was higher by PLN 5.6 million, i.e. 102.9%.

Now, the first quarter is a seasonally small quarter, last year it represented 5.4 million net profit out of 45.6 million PLN, so the variation here is not very important, but shows better cover of fixed costs by sales. We cannot expect a 102% increase in profit this year, especially with rising costs, but it is nonetheless encouraging.

Rising costs are mentioned by the CEO in the last earnings call.

Piotr Kaźmierczak: High margins are the result of introducing and increasing shares by the most profitable products and brands. In the coming quarters, however, strong factors will affect the growth of most costs, including wine and packaging, which may, to some extent, weaken the margin.

Of course, Ambra has noted that they will pass these costs in the price of their products. Being a drinks company, they will have no problems doing so.

For valuation, we have a PE of 12.2 today, based on last year’s earnings, and a small net cash position.

Future plans from the last two Q&A transcripts.

New products:

Maciej: Are you planning to expand your business to include other types of alcohol?

Robert Ogór: We are gradually expanding the area of our activity with new valuable alcohol market segments - premium vodkas, whiskey, premium alcohol imports, regional fruit wines. This process will continue to develop.

Michał: Are you planning to introduce new products to your offer?

Robert Ogór: Every year we introduce new products under our brands. The main novelties introduced in the last two years still have great growth potential.

Retail stores:

Piotrek: Are you going to continue the idea of opening stores in medium-sized towns, or has the pandemic stopped and called into question this idea?

Piotr Kaźmierczak: The pandemic temporarily stopped openings in medium-sized cities. We plan to go beyond the largest agglomerations - cities with more than 200,000. residents.

Capital allocation

Guest: Taking into account the improving financial situation of the company (decrease in debt, increase in cash position), does the management board want to return to more intensive work on some acquisitions on the market?

Robert Ogór: After purchasing the PLISKA and SŁONECZNY BRZEG brands, SANGE DE TAUR wines in Romania and fine wines in the Czech Republic, we are looking further.

Kazik: Are you considering buying back your own shares in the future, in addition to the dividend?

Piotr Kaźmierczak: We are not planning any share buyback.

→ So on shareholder friendliness and explanation, it is here quite low.

Conclusion

What we have here is a true hidden champion. This is a company with a strong moat with brands and distribution. The products are premium, the market is growing organically and in price.

The management team is very successful in rolling and promoting new products that generate market share gains. The management is not aggressive enough in terms of buyback and cash utilisation, but I can accept this due to the other positives. The dividend commitment is good.

The company deserves a premium to a PE of 20 versus 12 now due to the premium defensive products it sells. Ambra should keep providing reasonable earnings growth for shareholders and an increasing dividend.

This is just my personal opinion about the company and not investment advice. Do your own research before buying any stock. I own a position in Ambra.

Further research

You can check a full analysis from Millennium from mid 2021 (download and use a translator tool).

https://www.ambra.com.pl/assets/RI/Rekomendacje/Ambra_Millennium_KUPUJ.pdf

it gives an insight on the Ambra model for example.

These is a lot of inflation in poland so cash flow is going into inventory - also zloty is devaluating from 4.1 in 2013 to 4.78 now so a growth chart in euros would be better representation ...

Just going through the HY Results they published today. Did they just present Net income for HY2021/2022 at 45 M. PLN = Net income for the whole of last year? Am I missing something?