Hi, I decided to write this as an article in place of my regular monthly recap, which needs some more work that I could assign to it, and to publish it publicly.

I will also not run black Friday promotions for my substack. Subscribe exclusively at the full price below! I will run promotions after I see many ideas double and more. This has not been the case until now. The promotion is currently on the good stocks.

I was looking for more energy hedge protections for the portfolio and my shortlist pointed at these four stocks. I got inspiration from @mrierathelen on twitter who pointed that many European energy stocks are actually as cheap as the latin American Petrobras and Ecopetrol.

I will compare them with forward EV/EBITDA:

For many reasons, mostlyCapex needed to replenish reserves, and price cycle, EV/EBITDA is a terrible valuation metric for an oil company. However, it gives a good overview to compare different oil companies.

Forward EV/EBITDA:

Exxon Mobil 5.6

Total Energies 3.9

Shell 3.8

Repsol 2.6

OMV 2.3

VERMILION ENERGY 2.3

ORLEN 2

Another method for cyclicals is P/Book value.

Here is what @mrierathelen had to say about it (with his permission, translated from Spanish).

My favorite ratio to analyze by asset is the price / tangible book value (or “price / tangible book value”, P/TBV, in English). It's extremely simple, and that's why I like it: my way of outperforming the market is not about doing thoughtful analysis. The idea of this ratio is to compare the price of the share with the price of the company's net worth on its balance sheet, without counting intangibles. This, in cyclical companies based on commodities, with few barriers to entry and in which their intangibles barely have value, gives you a realistic representation of what they could get for the company if one day it occurs to them to stop operating and sell their parts to the market.

(...)

You cannot expect that a business like Enagás (Spanish gas transportation company, monopoly, great capacity to set prices) is at the same ratio as a sh**ty microcap on the coast of Angola pumping oil at $70/barrel.

Therefore, the flagship oil companies of each country will always be more expensive; since many of them, apart from the upstream (extracting oil, pure and simple), have control of the transportation of oil (midstream) and the refining, processing and sale to the minority (downstream), which gives them more potential profitability due to economies of scale and vertical integration. If we find a flagship oil company below a P/TBV of 1, it is surely cheap.

Then we would have to read the annual report and see what proportion each business is(...)P/BV

Exxon Mobil 2

Total Energies 1.3

Shell 1.1

Repsol 0.7

OMV 0.7

VERMILION ENERGY 0.7

ORLEN 0.5

As you will see they have different profiles in terms of portfolio

REPSOL (SPAIN)

This company has large downstream and upstream segments, and an industrial petrochemical segments. The industrial and downstream is mostly in Spain. The upstream is largely global.

The capital allocation is growing a big renewable energy portfolio very aggressively. With a lot of presence in Spain, Chile and the USA, solar is in areas with good exposure and potential to be competitive. There is also wind.

The company is reducing the oil and gas upstream, and investing also in green hydrogen and renewable chemicals.

Other than that, it has paid down most of the debt, pays a good dividend and buys back shares aggressively. This is a company moving fast.

Opportunities:

Downstream and upstream are well balanced to benefit from higher prices while doing well with lower prices.

Downstream segment well positioned to grow a fintech and customer business due to Repsol presence in Spain. I registered to the wallet to test and it’s pretty tempting with rewards. Alas, I don’t drive and they are redeemed in fuel discounts.

Solar energy segment with the best productivity in Europe (Spain is the sunniest) and good established company in Spain.

Risk:

Exiting upstream too aggressively

Buying renewable assets too expensively (Should be balanced with the buyback)

Electricity prices dropping to zero during peak solar or wind hours.

Windfall taxes

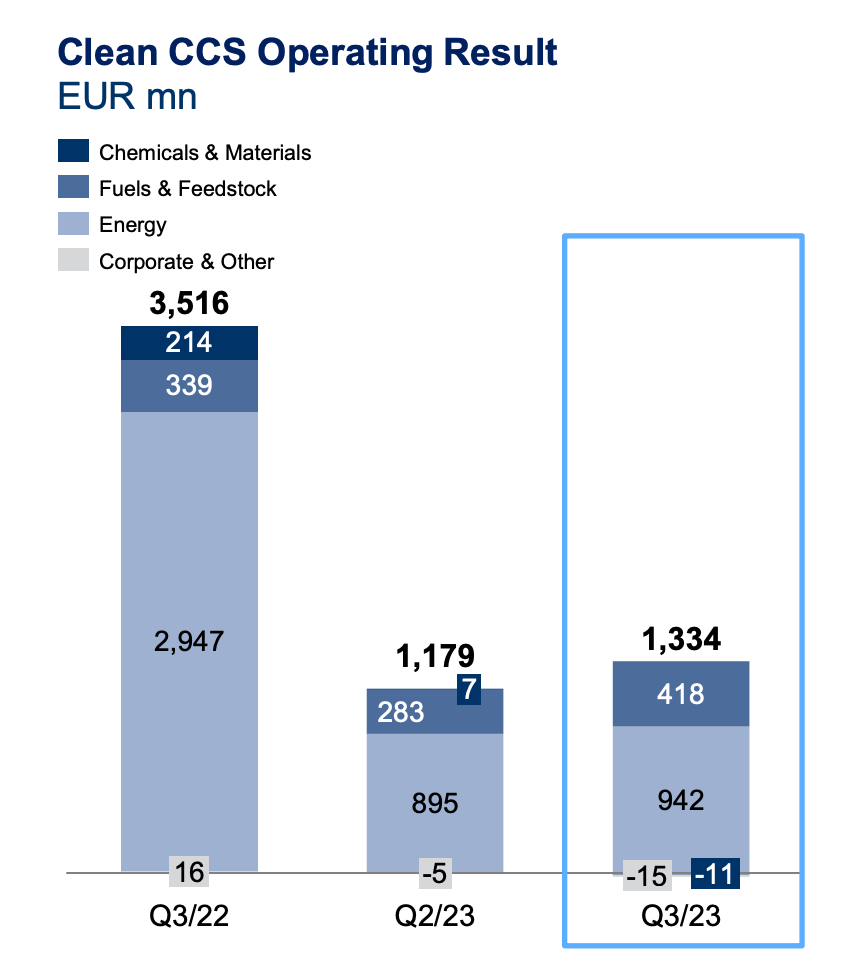

OMV (AUSTRIA)

The portfolio of OMV is more weighted towards upstream, with a small proportion of downstream, and is increasingly putting most of their investments into sustainable chemicals.

However, in the recent quarter the chemicals were at a loss. Producing pellets and materials for the heavy and automotive industries, these seem even more cyclical than oil.

The capital allocation is mostly dividends, special dividends too, and more investment in chemicals.

The debt is low.

Opportunities:

Good exposure to upstream and oil prices

Chemical segment can be a good profit centre and the company plans to double ebitda.

No renewables portfolio

Risk:

Chemical segment seems very cyclical and was recently loss making.

No renewables portfolio

ORLEN (POLAND)

The company proportion of upstream and impact of the energy prices is very minor in the business mix. It cannot be therefore an energy crisis hedge.

ORLEN is also partially state owned and recently grew by acquiring industrial and downstream businesses. I read some write ups but none give me the clarification needed to fully understand it, breaking the segments one by one is required for this.

Upstream was loss making in Q3 2023 and is not looking positive because of losses in the gas production segment constituting the large majority of Upstream.

This segment is not to be confounded with the “Gas” segment that is Trade and Storage only.

The Polish government just announced a cap on energy prices financed by a retroactive windfall tax levied on companies like Orlen. It is a huge negative for the company.

Orlen has an aggressive CAPEX plan and does what the Polish state needs strategically, not necessarily the best option for shareholders.

Opportunities:

Safe downstream business

L&NG projects

Growth Capex

Risk:

Not an energy hedge

Aggressive growth plans

State controlled, windfall taxes

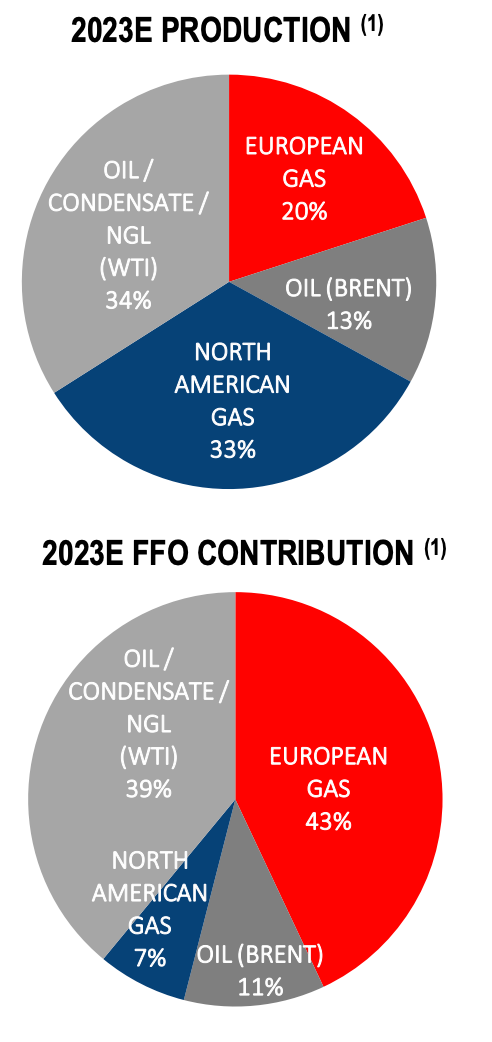

VERMILION ENERGY (CANADA)

This company is a pure Exploration & Production stock. It is Canadian but derives many earnings from Europe and has strategic assets there.

Vermillon used to be a monthly dividend payer but got caught with too much debt during the low energy price crisis of 2020, and had to reduce the dividend to a pity before growing it again, but is preferring a large allocation to buybacks.

The company is deleveraging and will increase dividends and buybacks when the 1 billion dollars net debt target will be met, and the company is getting close to the target.

Opportunities:

Widely diversified

Exploration in Europe

Can buy assets from Majors

Very exposed to energy prices

Risk:

No downstream or industrial, more exposed to energy prices.

More buybacks than dividends: more leverage to the outcome.

Conclusion:

Personally I am more comfortable with Repsol due to the upstream+downstream and industrial mix, the buybacks and dividends.

OMV has the problem of the money losing industrial segment, but overall a very good exposure to energy production.

Orlen is a state owned company working more in Capex for the Polish state than for itself. It is a very complex company focused on downstream and chemicals. A deeper dive to understand their future potential in upstream would be required.

Vermilion energy is a very good opportunity in my opinion, but is purely exposed to energy prices, as it does not have a downstream segment. I have no idea where energy prices are going, especially gas. Low prices are already discounted in the low valuation of the company.

Honorable mention:

MOL (Hungary) (Ratios of 2.4 and 0.5 for the Book value), I just could not find it in my broker, even thought it has an ADR in London, so I did not review it.

MOL has a good mix of products and services.

The last words are what someone with a large capital should do: Just buy them all. by applying this technique, you are getting a diversified baskets of cheap assets. I have no idea what they are going to do individually, what government is going to do something bad. Otherwise, predicting the future earnings of Vermilion and Orlen seems like a fools game.

Write ups:

The above write ups, as well as my portfolio, show that EMs are priced for the opportunity of a lifetime. I am more optimistic than the writer on First Pacific and Indofoods, as for me value is it’s own catalyst and I have extreme patience.

I like JD, because it is now a Chinese tech stock, a sort of Amazon that pays a dividend, despite pricing competition in E-commerce. It is added to the watchlist.

I love the Slovenian bank, with exposure to under-developed markets of the Balkans and a good price. It is added to the watchlist.

Movements:

I Added to Repsol and Eurofins Scientific to complete my lines. Eurofins is not the cheapest stock but it was to complete my long term quality position, this is a very high quality dominant business at an EV/EBITDA of 10.

“Worldwide laboratory testing services - Eurofins Scientific

World leader in food, environment, pharma product testing & agroscience CRO services; 62000+ staff across a network of more than 1000 independent companies”

In the end, value investing is for me investing with a margin of safety due to the low price expectations, and without predicting the future. This is what this article is about.

I think OMV came with some Russian risk.

hello,

Some IMPORTANT LEGAL RISKS are worth mentioning about Repsol :

1. Oil spill in the Peruvian sea,

risk USD 5 879 M€

provision : ZERO !

2. Arbitration Following the acquisition of Talisman Energy UK Limited (TSEUK),

risk : USD 5 500 M€

provision : 779 M€

https://ojo-publico.com/4359/litigation-and-sanctions-against-repsol-triples-its-global-earnings

Some 10B€ unprovisonned risks vs a current market cap at 18B€.

-> need definite investigations before investing ..