It has been about one year that the Substack was launched. It’s time to start reviewing the thesis that I published, starting from the oldest.

The markets have been going up and down. I have few interest in this, so let’s go talk about companies. This is what interests me.

Lam Soon Hong Kong

-55% for the first idea. Ouch! I had it in portfolio but I sold it before a lot of the drop. pfew.!The reason is simple. Lam Soon buys wheat to make flour in one of its main businesses, and edible oils in the other businesses and raw material inflation became a theme in investment media. The stock also literally started going down a few days after the war in Ukraine started. When facts change, we need to adapt.

However, the company had already mentioned inflation pressure on costs and reduced earnings before that date.

This is still a long term grower with decent long term margins, that reinvests in growth constantly in the form of new factories.

The thesis was too optimistic but not long term impaired and I will check the company again in the future because it is growth + value.

Financials: Annual revenue was up 6% and profit down 28%.

Verdict: Still an interesting one, and a low PE ratio on depressed earnings would be a good re-entry point. The stock is net cash as well. The downside is that they don’t have the same pricing power as a Pepsi or AB-inbev and that they do not invest their cash aggressively enough. Therefore, I am out.

Indofoods.

This is a short write up where there was almost nothing to say. Indonesia food Giant under 10 PE and distributing dividends. I wrote it probably at peak compounder brother giant write-up-price-does-not-matter-2030-ebitda-time.

It felt weird going for a simple write up at this time, because the long write up + DCF trend almost made me feel like a Fraudulent writer for keeping it short.

But it did well, and this comforts me in an approach that has value in the center, and future + growth as a “nice to have” on top of it. I love growth but few can guarantee the rate of growth, and I prefer not to put an estimate on it.

The annual report 2021 shows that the agri business is responsible for a good part of the earning growth and that could reverse or slow down in 2023. It represented 19% of operating profit in 2021. There are some minority stakes, but overall its not that different from 19%. Indofoods input costs of raw materials for the customer product division was more than compensated by higher sales of raw materials in the agriculture division.

However it is still a long term growing company at a PE ratio of 7. (BTW the Rupiah is stable).

Financials: For the year 2021, revenue is up 22% and adjusted profit 35%.

For the 6 months 2022, revenue is up 12% and adjusted profit up 4%.

Verdict: I still love it

Poland basket:

These 4 ideas have corrected a lot and the PLN is down heavily to the USD. I do not own all these names anymore, just Ambra. I used to, but I did a bit or trading in and out, and they were not in retrospect, all of the highest quality. Since then, my reading of local blogs and searching allowed me to upgrade the quality of my Polish basket.

GPW: stock exchange, a stock exchange at under 10 PE in a developed market and with a dividend yield of 7.5% according to google! Sold as a tiny loss because actually I arbitrated towards another Polish stock. In retrospect the Idea was a bit of an error at this price because it is not growing a lot recently and even de-growing. I feel that Polish investors got defrauded by an overpriced Allegro IPO and it will take some time for these people to come back into buying stocks (until they go back up basically). Once good investing returns come back, trading volume will increase and GPW will profit. The other issue with this stock is that the company is government owned and they do not really push for growth and cost controls.

Financials: H1 22 revenue flat and profit down 15%.

Verdict: it was a bad timing, and there is a bottom to pick but the management needs to improve as well.

PZU: insurance: The stock is down a lot and is very cheap now. P/E of 7, state owned, dividend is big. The combined ratio is very very good, but one needs to be able to assess the recent interest rate rises and the stress on the company. I haven’t done this homework, but I really like it for a dividend portfolio. The problem is that waiting for a financial stock to re-rate to a PE of 15-20 is a hopeless game unless it is Berkshire or Fairfax. This is the only time where intrinsic value does not matter.

Financials: Q2 net profit down 4%.

Verdict: It is interesting, especially for a dividend portfolio.

AMBRA: A wine company. I have a full write up for this stock. It is also down a bit. Not much to talk about. The company increased revenue by 15% and profits by 13%. Verdict: I happily hold.

TOYA: Tools: -40% in PLN so -55%? I am Not long anymore since a long time. I don’t remember why I sold, probably to buy some other thing. Edit: Looking at my broker I bought AB inbev with the profits, so to get more conservative in terms of business model. Could have been to do with the lower dividend proposed in 2021. Not that I avoid losses completely or try to be a Puru Saxena who sells everything on top and buys everything at the bottom, because I own TIM (An electricity material distributor in Poland too) and my position in TIM is now down 20% on inflation fears. I just happen to be out of Toya but not out of TIM. I recently wrote about TIM and I prefer it’s risk reward compared to TOYA. Clearly the war in Ukraine will affect TOYA’s results, with 8% of sales in the country. The company is building a new warehouse in China to improve supplies and support e-commerce. For this, and due to geopolitical risks, they have cancelled the proposed dividend.

Finances: Toya website is currently down!

Verdict: At a 5 PE ratio, it is clearly a company to watch, and seeing how it handles this stressful time will tell a lot about the quality of Toya.

I was recently adding to more polish positions that are not in this list. I think that it is currently my favorite market. I don’t worry about the macro or the fights in the EU institutions over Poland. I love Poland’s Debt/GDP ratio and work ethics. Their businesses are awesome because many are starting small and are like western companies a few decades ago, starting their European expansion now. I think this has to do with the companies starting only from 1990.

I increased my knowledge of Polish companies over time and tend to own other owner operated ones instead of state owned companies, and more hidden champions with better growth prospects. If you like Poland, I recommend this column with stock analysis. There is a lot to read there:

https://www.biznesradar.pl/temat/54,wiesz-w-co-inwestujesz

MTN Group: African telco:

This is an idea with positive returns. The company has had good development in terms of sales and subscribers, and managed to reduce its debt a lot at the “holdco” level. I am expecting large capital returns from now on and a continued leadership in African tech. Forget Jumia, this is the best positioned African tech company.

Financials: for H1 22, Revenue and ebitda are up 15% approx. Net profit is not comparable due to accounting losses in 2021.

It is not as cheap, verdict: Happily holding but not necessarily a strong buy right now

Jardine Cycle and Carriage:

The Indonesia focused conglomerate listed in Singapore did very well with commodity induced growth and improvements in the Vietnam car business. The company is conservatively run and did not do main changes in investments this year.

For H1 22, revenue was up 29% and net profit recovered at +115%.

Verdict: Happily holding. This is a long term Asian compounder.

Newlat Foods (Italy)

The stock went down but the business got better. First they manage to benefit from inflation and pass price increases while having fixed debt. Secondly they did an acquisition in the UK and synergies are working well. They also had good synergies on their past Italian acquisition. Time is proving that this management is of excellent quality operationally. They do daily buybacks and are in advanced talks to make a big acquisition that would be very accretive to earnings.

I recently bought back a position when I was happily surprised with these developments. (Before the latest stock drop this time, so I am already down!). For H1 2022, revenue is up 10% and ebit 9.5%. Verdict: I like it a lot at this price.

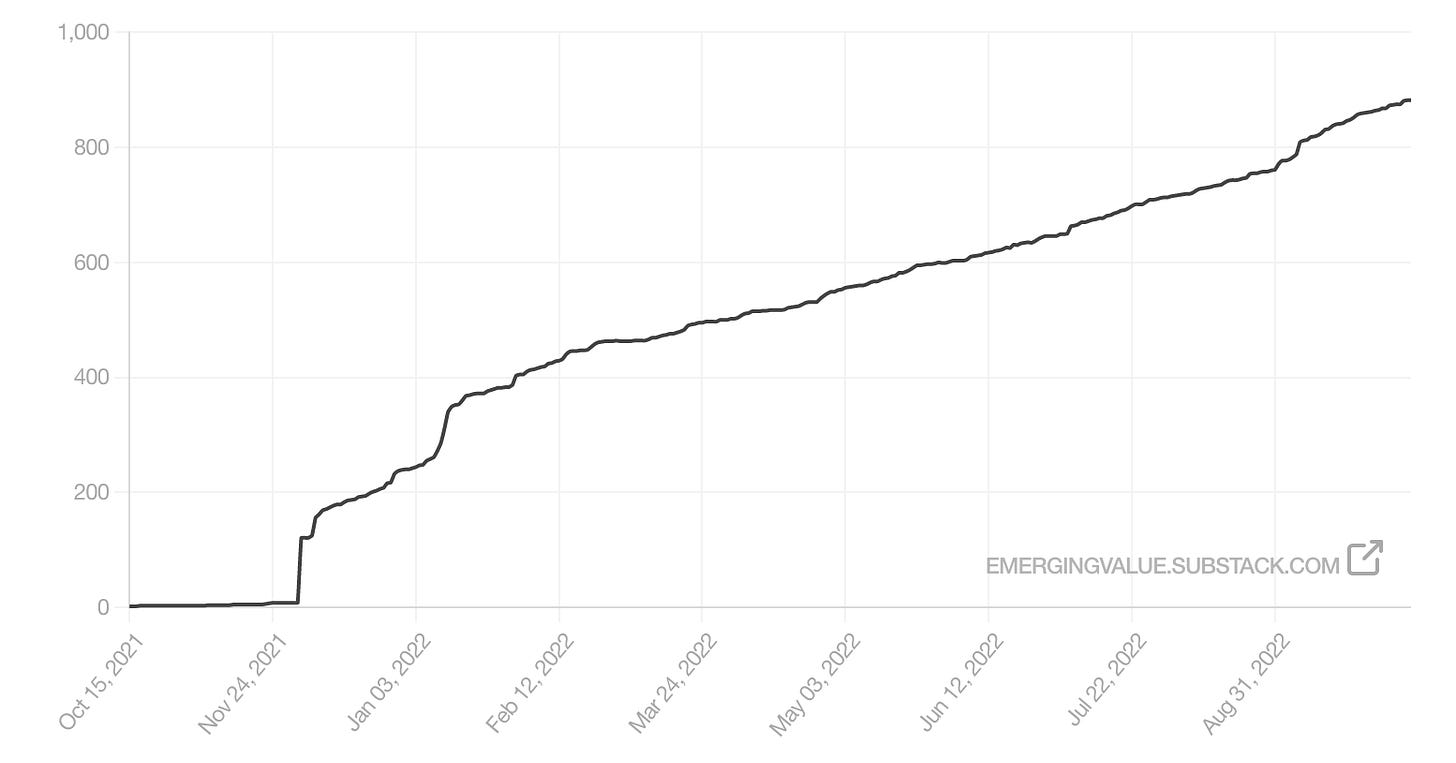

This publication started out of covid lockdowns boredom, and I am now so glad that I started it, as it gave me a sense of purpose and building something when the world was claustrophobic. I also like to dig more about the stocks I own, and writing about them is an exercise in getting to know them even more than before. Sometimes with stocks we see just numbers on a screen. I feel that I got better in analysing stocks when I reread my old posts and it is due to feedback and practice. I am happy that some people follow me for ideas and insights!

I also started a paid membership this summer. This was the next step to share more private and make it a side activity.

Thanks for reading this update. In the future I will cover the next batch of companies.

If you like unique ideas in value land, think about upgrading for the paid membership.

This publication is my side activity and I love the support I received so far. The premium membership is my whole deck with more ideas.

What you get is access to:

Exclusive write ups

A fully accessible watchlist and deck spreadsheet

Monthly recaps with other people write ups from various languages circles and interesting stocks.

Full portfolio reviews with more hidden gems.

I bring defensive value picks like the ones above, that should in my opinion provide adequate returns and protection over the following years.

I can also give free access to any student - contact me and I will arrange it.

Note: this is not financial advice, but my opinion on the companies presented. Anyone should do their own due diligence to confirm a company thesis presented and form their independent opinion.

It was a pleasure reading this! Could you please share some of the local Polish blogs you mentioned?

Really nice writeup. I think I like Indofoods and Newlat the most and have put them in my ideas list. Thank you so much for your generosity and warm regards from Madrid. :)